All Categories

Featured

Table of Contents

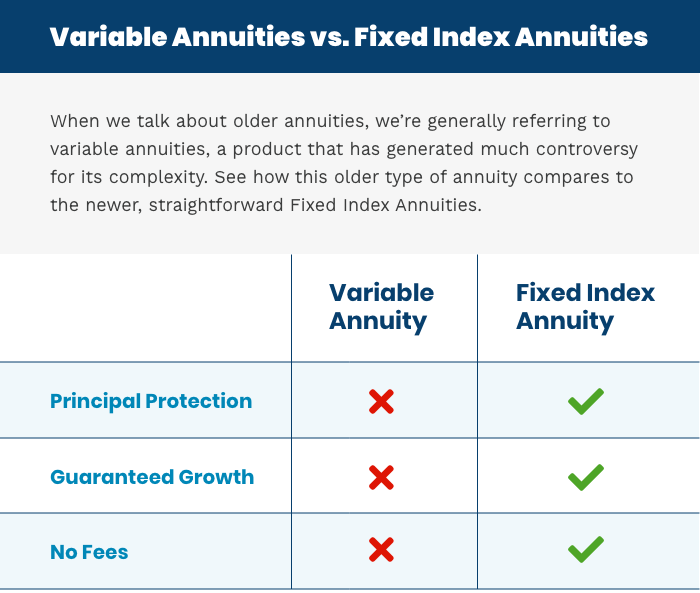

Variable annuities have the capacity for greater revenues, but there's even more risk that you'll lose money. Be cautious regarding putting all your properties into an annuity.

Annuities marketed in Texas needs to have a 20-day free-look period. Substitute annuities have a 30-day free-look duration.

The amount of any surrender fees. Whether you'll shed any type of benefit interest or features if you quit your annuity. The ensured rates of interest of both your annuity and the one you're taking into consideration replacing it with. Just how much money you'll require to start the brand-new annuity. The lots or commissions for the brand-new annuity.

Ensure any representative or company you're thinking about getting from is accredited and economically stable. annuity money. To confirm the Texas permit status of a representative or business, call our Customer service at 800-252-3439. You can also use the Business Lookup function to learn a business's monetary rating from an independent ranking company

There are 3 kinds of annuities: dealt with, variable and indexed. With a repaired annuity, the insurance provider assures both the rate of return (the rates of interest) and the payment to the capitalist. The rate of interest rate on a repaired annuity can transform in time. Frequently the rates of interest is taken care of for a number of years and after that adjustments regularly based upon existing rates.

The Term Fixed In A Fixed Annuity Refers To

With a deferred fixed annuity, the insurance provider agrees to pay you no much less than a specified price of rate of interest as your account is growing (withdrawing from an annuity). With a prompt set annuityor when you "annuitize" your delayed annuityyou receive an established set quantity of money, typically on a regular monthly basis (similar to a pension plan)

And, unlike a repaired annuity, variable annuities don't supply any type of guarantee that you'll gain a return on your investment. Instead, there's a threat that you might in fact shed cash.

Due to the intricacy of variable annuities, they're a leading source of capitalist issues to FINRA. Before getting a variable annuity, meticulously read the annuity's prospectus, and ask the individual marketing the annuity to explain all of the product's features, bikers, prices and constraints. Indexed annuities typically offer a minimum guaranteed passion price integrated with a rate of interest rate linked to a market index.

Comprehending the functions of an indexed annuity can be complicated (annuity with inflation protection). There are a number of indexing techniques firms utilize to determine gains and, as a result of the range and intricacy of the techniques utilized to credit rating passion, it's tough to compare one indexed annuity to an additional. Indexed annuities are typically categorized as one of the complying with two kinds: EIAs offer an ensured minimum passion price (typically at the very least 87.5 percent of the costs paid at 1 to 3 percent passion), as well as an added rates of interest linked to the performance of several market index

5. The S&P 500 Index consists of 500 large cap stocks from leading companies in leading sectors of the United state economic climate, recording about 80% coverage of United state equities. The S&P 500 Index does not consist of returns declared by any of the business in this Index.

The LSE Group makes no insurance claim, forecast, warranty or depiction either regarding the outcomes to be acquired from IndexFlex or the suitability of the Index for the objective to which it is being put by New York Life. Variable annuities are long-lasting monetary items made use of for retirement cost savings. There are fees, expenditures, limitations and dangers associated with this policy.

Withdrawals might undergo ordinary earnings tax obligations and if made before age 59 might go through a 10% IRS penalty tax. For prices and total information, call an economic expert. This product is basic in nature and is being attended to informative objectives only (spia annuity rates). It was not prepared, and is not planned, to deal with the needs, situations and/or purposes of any particular individual or group of people.

The programs contain this and other info regarding the item and underlying investment alternatives. Please review the prospectuses meticulously before investing. Products and functions are available where accepted. In a lot of jurisdictions, the policy type numbers are as follows (state variations may use): New york city Life IndexFlex Variable AnnuityFP Collection (ICC20V-P02 or it might be NC20V-P02).

Life Income

An earnings annuity starts dispersing repayments at a future day of your option. Dealt with deferred annuities, also understood as repaired annuities, offer stable, guaranteed development.

The value of a variable annuity is based on the performance of an underlying profile of market financial investments. immediate fixed annuity rates. Variable annuities have the benefit of offering more options in the means your money is invested. This market exposure might be needed if you're trying to find the opportunity to grow your retired life savings

This material is for info usage just. It must not be counted on as the basis to acquire a variable, repaired, or prompt annuity or to apply a retirement method. The details given herein is not composed or intended as financial investment, tax obligation, or lawful advice and may not be depended on for objectives of avoiding any type of government tax penalties.

Tax outcomes and the relevance of any kind of item for any type of particular taxpayer may differ, depending upon the certain set of truths and conditions. Entities or individuals distributing this information are not accredited to give tax obligation or lawful suggestions. Individuals are motivated to seek particular recommendations from their personal tax or legal counsel.

If withdrawals are taken prior to age 59, a 10% IRS charge might additionally apply. Withdrawals might likewise go through a contingent deferred sales cost. Variable annuities and their underlying variable investment choices are marketed by prospectus just. Investors need to consider the financial investment purposes, threats, fees, and expenses very carefully prior to spending.

Definition Deferred Annuity

Please read it prior to you spend or send cash. Taken care of and variable annuities are issued by The Guardian Insurance Policy & Annuity Firm, Inc. (GIAC). All assurances are backed exclusively by the toughness and claims-paying capacity of GIAC. Variable annuities are released by GIAC, a Delaware firm, and dispersed by Park Avenue Securities LLC (PAS).

5 Enjoy out for taken care of annuities with a minimum guaranteed interest price of 0%. Enjoy out for advertisements that reveal high interest prices.

Some annuities use a higher guaranteed interest for the very first year only. Make sure to ask what the minimal rate is and just how long the high passion price lasts.

Guaranteed Annuity Income Calculator

You typically can not take any type of added money out. The primary reason to buy an instant annuity is to get a routine income as soon as possible in your retirement. Deferred Annuity: You start getting income years later, when you retire. The major reason to acquire a deferred annuity is to have your cash expand tax-deferred for some time.

This material is for informational or academic objectives only and is not fiduciary financial investment suggestions, or a securities, investment approach, or insurance product suggestion. This product does not consider a person's very own goals or situations which need to be the basis of any type of financial investment decision. Financial investment items might be subject to market and other threat aspects.

Table of Contents

Latest Posts

How Safe Are Annuities

Breaking Down Variable Annuity Vs Fixed Annuity A Comprehensive Guide to Investment Choices What Is Pros And Cons Of Fixed Annuity And Variable Annuity? Features of Tax Benefits Of Fixed Vs Variable A

Highlighting the Key Features of Long-Term Investments A Closer Look at How Retirement Planning Works Defining Fixed Index Annuity Vs Variable Annuity Pros and Cons of Various Financial Options Why Ch

More